Which Of The Following Cash Transactions Results In No Net Change In Assets?

Statement of Cash Flows

97 Fix the Statement of Cash Flows Using the Indirect Method

The statement of cash flows is prepared by following these steps:

Step 1: Decide Net Cash Flows from Operating Activities

Using the indirect method, operating net cash flow is calculated every bit follows:

- Brainstorm with internet income from the income argument.

- Add together back noncash expenses, such as depreciation, amortization, and depletion.

- Remove the effect of gains and/or losses from disposal of long-term assets, as cash from the disposal of long-term assets is shown under investing cash flows.

- Adjust for changes in current assets and liabilities to remove accruals from operating activities.

Pace two: Determine Cyberspace Cash Flows from Investing Activities

Investing net cash period includes cash received and cash paid relating to long-term assets.

Pace three: Present Net Greenbacks Flows from Financing Activities

Financing net cash flow includes greenbacks received and cash paid relating to long-term liabilities and equity.

Step 4: Reconcile Total Cyberspace Cash Flows to Change in Cash Residuum during the Menstruum

To reconcile beginning and ending cash balances:

- The net cash flows from the offset 3 steps are combined to exist total net cash flow.

- The beginning greenbacks residuum is presented from the prior year balance canvass.

- Full internet cash flow added to the beginning cash balance equals the ending cash balance.

Step 5: Present Noncash Investing and Financing Transactions

Transactions that do not affect cash but do affect long-term assets, long-term debt, and/or equity are disclosed, either equally a annotation at the bottom of the statement of cash period, or in the notes to the financial statements.

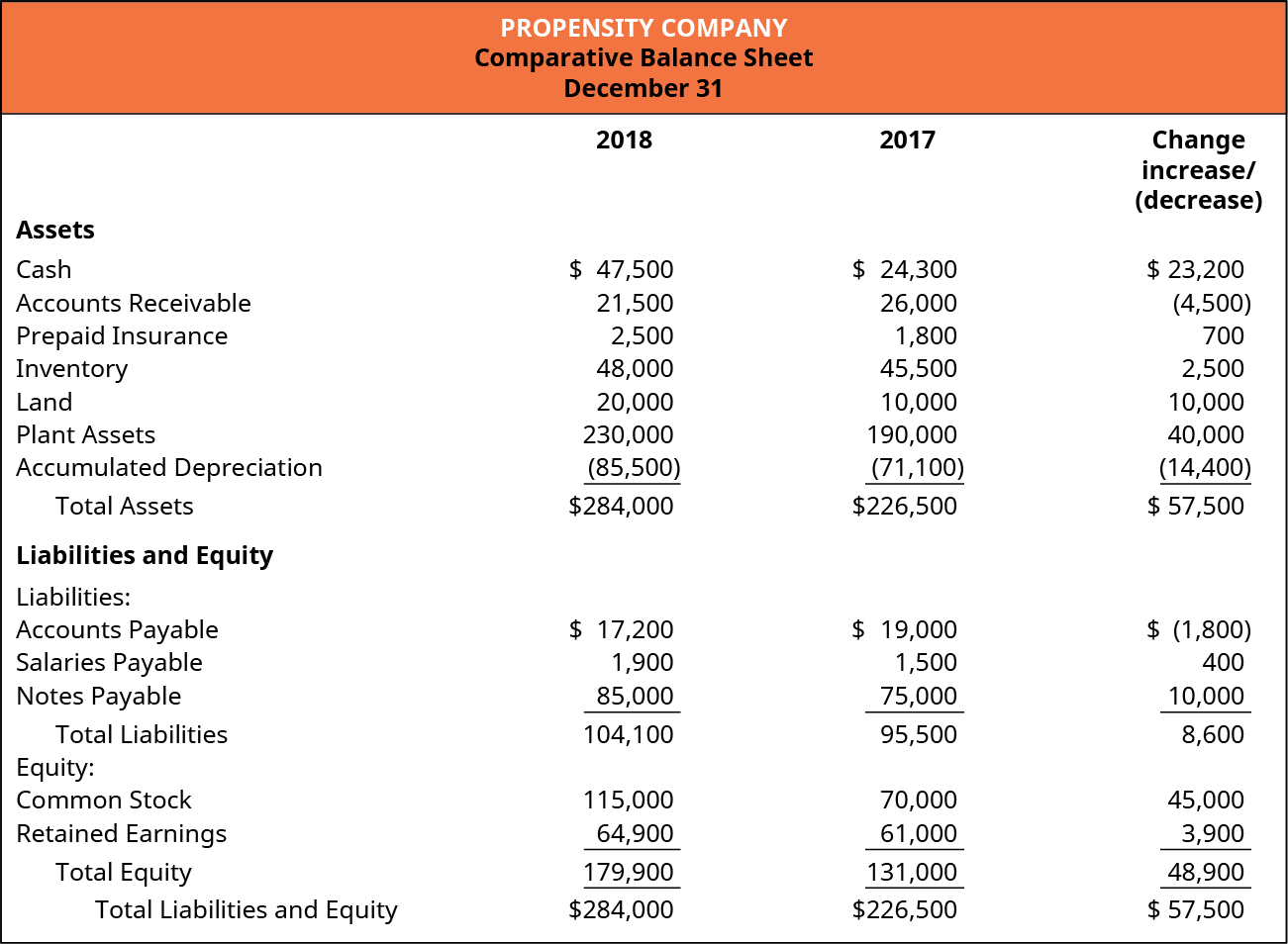

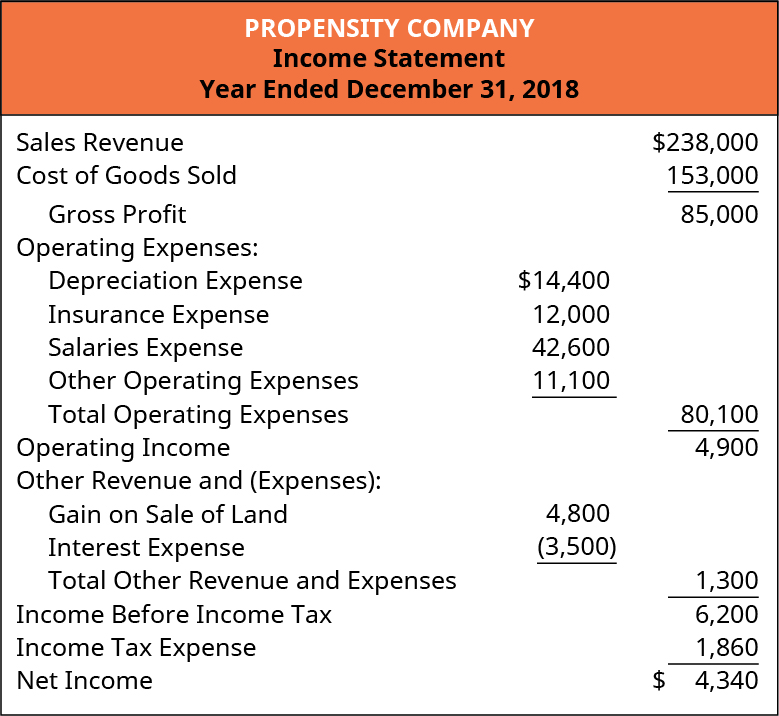

The remainder of this section demonstrates preparation of the statement of cash flows of the company whose financial statements are shown in (Effigy), (Effigy), and (Effigy).

Comparative Rest Canvass. (attribution: Copyright Rice Academy, OpenStax, under CC BY-NC-SA 4.0 license)

Income Statement. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

Boosted Data:

- Propensity Visitor sold state with an original toll of $10,000, for $14,800 cash.

- A new packet of country was purchased for $xx,000, in exchange for a note payable.

- Plant assets were purchased for $40,000 cash.

- Propensity alleged and paid a $440 cash dividend to shareholders.

- Propensity issued mutual stock in commutation for $45,000 cash.

Statement of Cash Flows. (attribution: Copyright Rice Academy, OpenStax, under CC BY-NC-SA 4.0 license)

Set the Operating Activities Section of the Argument of Greenbacks Flows Using the Indirect Method

In the following sections, specific entries are explained to demonstrate the items that support the preparation of the operating activities section of the Statement of Cash Flows (Indirect Method) for the Propensity Visitor instance financial statements.

- Begin with internet income from the income argument.

- Add dorsum noncash expenses, such as depreciation, amortization, and depletion.

- Reverse the effect of gains and/or losses from investing activities.

- Adjust for changes in electric current assets and liabilities, to reflect how those changes impact cash in a style that is different than is reported in net income.0

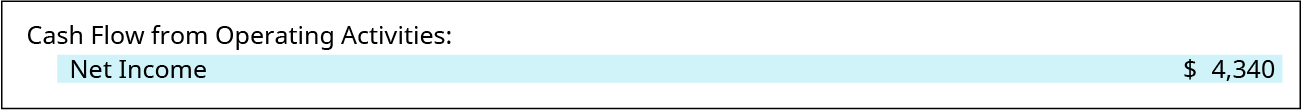

Start with Net Income

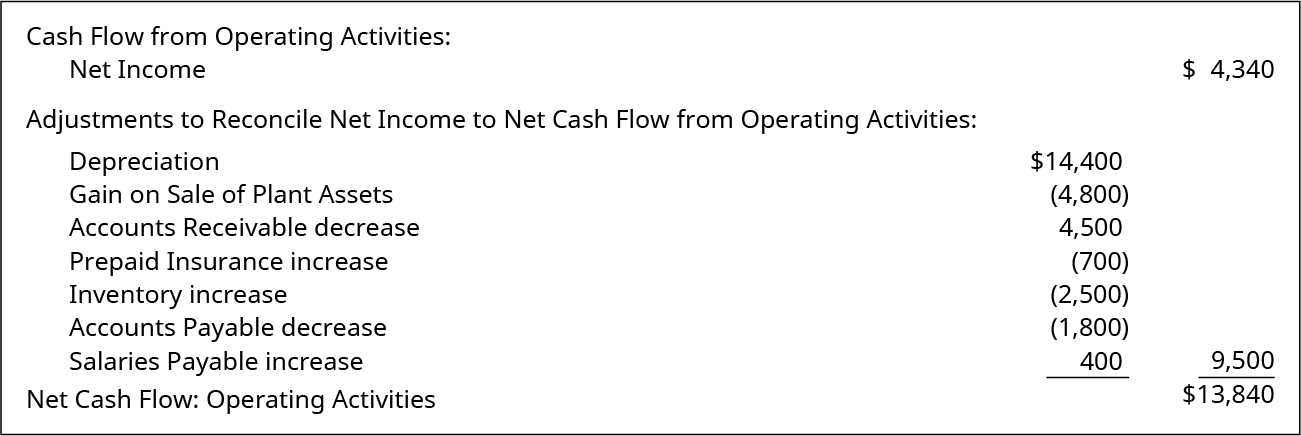

The operating activities greenbacks catamenia is based on the company's net income, with adjustments for items that affect cash differently than they affect net income. The net income on the Propensity Company income statement for Dec 31, 2018, is $4,340. On Propensity's argument of cash flows, this amount is shown in the Greenbacks Flows from Operating Activities department as Cyberspace Income.

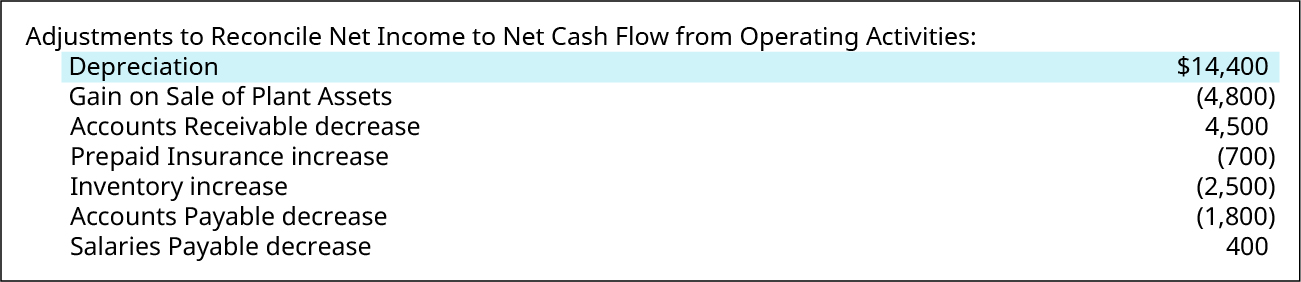

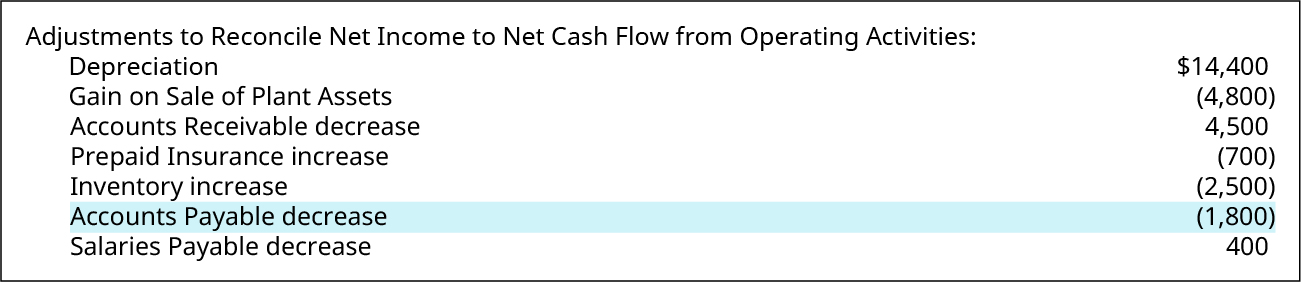

Add Back Noncash Expenses

Internet income includes deductions for noncash expenses. To reconcile net income to cash flow from operating activities, these noncash items must be added dorsum, because no cash was expended relating to that expense. The sole noncash expense on Propensity Visitor's income statement, which must exist added dorsum, is the depreciation expense of $14,400. On Propensity's statement of cash flows, this corporeality is shown in the Greenbacks Flows from Operating Activities department every bit an adjustment to reconcile internet income to net cash menstruation from operating activities.

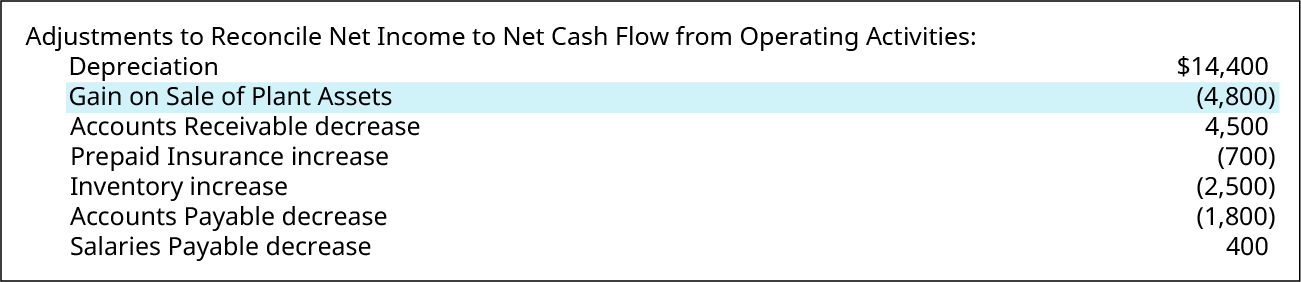

Contrary the Effect of Gains and/or Losses

Gains and/or losses on the disposal of long-term assets are included in the calculation of internet income, just greenbacks obtained from disposing of long-term assets is a cash flow from an investing action. Because the disposition gain or loss is not related to normal operations, the adjustment needed to arrive at cash catamenia from operating activities is a reversal of any gains or losses that are included in the net income total. A gain is subtracted from net income and a loss is added to net income to reconcile to cash from operating activities. Propensity's income argument for the year 2018 includes a proceeds on sale of land, in the amount of $4,800, then a reversal is accomplished by subtracting the proceeds from cyberspace income. On Propensity'southward argument of cash flows, this amount is shown in the Cash Flows from Operating Activities section every bit Gain on Auction of Establish Assets.

Adjust for Changes in Current Avails and Liabilities

Because the Balance Canvas and Income Argument reverberate the accrual ground of accounting, whereas the statement of cash flows considers the incoming and approachable cash transactions, in that location are continual differences between (i) cash collected and paid and (two) reported revenue and expense on these statements. Changes in the various current avails and liabilities can be determined from analysis of the visitor'southward comparative rest canvas, which lists the electric current period and previous period balances for all assets and liabilities. The post-obit four possibilities offer explanations of the blazon of deviation that might arise, and demonstrate examples from Propensity Company's statement of cash flows, which stand for typical differences that arise relating to these electric current assets and liabilities.

Increase in Noncash Current Avails

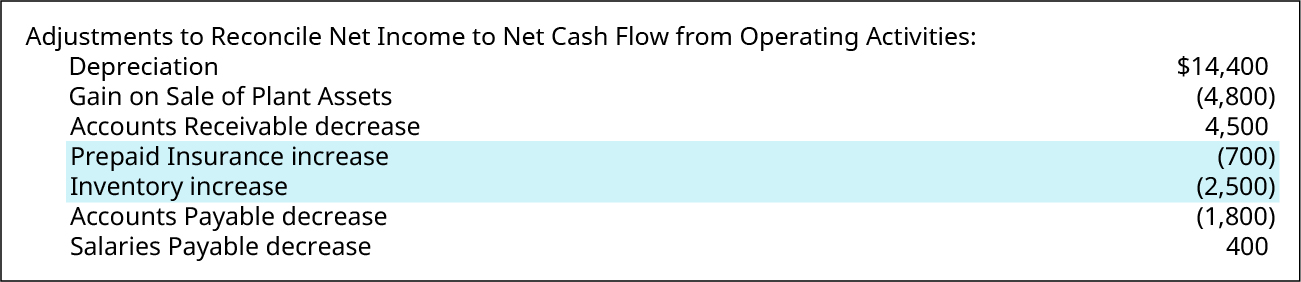

Increases in current assets point a decrease in cash, considering either (1) cash was paid to generate another current asset, such as inventory, or (ii) revenue was accrued, but not yet collected, such as accounts receivable. In the commencement scenario, the utilise of cash to increase the current assets is non reflected in the net income reported on the income statement. In the second scenario, revenue is included in the net income on the income statement, merely the greenbacks has not been received by the stop of the period. In both cases, current assets increased and net income was reported on the income statement greater than the actual net cash bear upon from the related operating activities. To reconcile net income to greenbacks catamenia from operating activities, subtract increases in current assets.

Propensity Visitor had two instances of increases in electric current avails. I was an increase of $700 in prepaid insurance, and the other was an increment of $2,500 in inventory. In both cases, the increases can exist explained equally additional greenbacks that was spent, merely which was not reflected in the expenses reported on the income argument.

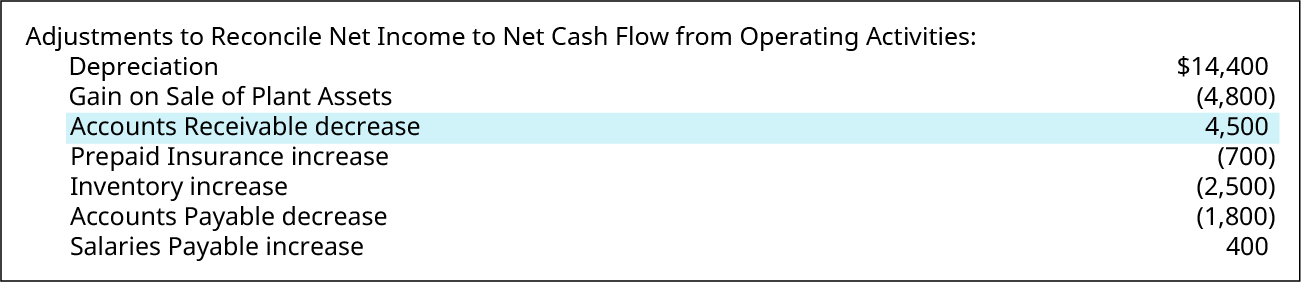

Decrease in Noncash Current Avails

Decreases in current assets point lower internet income compared to cash flows from (1) prepaid assets and (2) accrued revenues. For decreases in prepaid avails, using upwards these assets shifts these costs that were recorded equally assets over to current period expenses that and so reduce net income for the menstruum. Cash was paid to obtain the prepaid asset in a prior menstruum. Thus, cash from operating activities must exist increased to reflect the fact that these expenses reduced net income on the income statement, but cash was not paid this period. Secondarily, decreases in accrued revenue accounts indicates that cash was nerveless in the electric current period just was recorded as revenue on a previous period's income statement. In both scenarios, the net income reported on the income argument was lower than the actual net cash outcome of the transactions. To reconcile internet income to greenbacks catamenia from operating activities, add decreases in current avails.

Propensity Company had a decrease of $4,500 in accounts receivable during the period, which normally results only when customers pay the balance, they owe the company at a faster rate than they accuse new account balances. Thus, the subtract in receivable identifies that more cash was nerveless than was reported equally revenue on the income argument. Thus, an addback is necessary to calculate the greenbacks menses from operating activities.

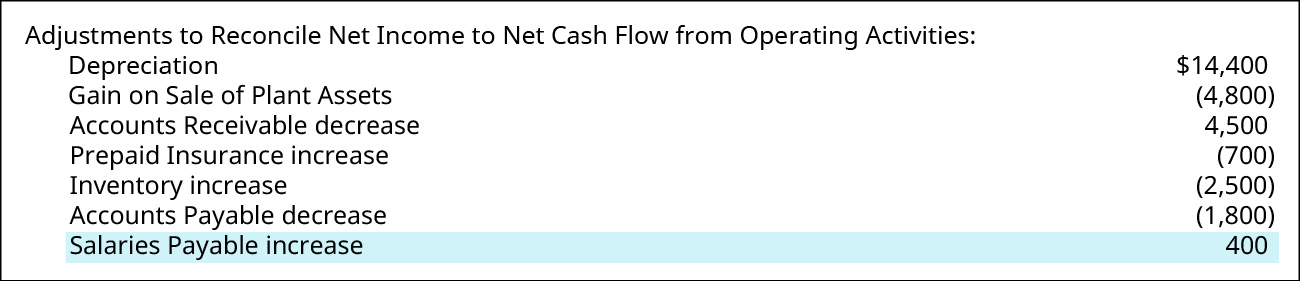

Current Operating Liability Increase

Increases in current liabilities indicate an increase in cash, since these liabilities generally represent (1) expenses that have been accrued, but not yet paid, or (two) deferred revenues that have been nerveless, but non yet recorded as acquirement. In the case of accrued expenses, costs have been reported as expenses on the income statement, whereas the deferred revenues would arise when greenbacks was collected in accelerate, but the revenue was not yet earned, so the payment would not be reflected on the income statement. In both cases, these increases in electric current liabilities signify cash collections that exceed net income from related activities. To reconcile net income to cash flow from operating activities, add increases in current liabilities.

Propensity Company had an increase in the electric current operating liability for salaries payable, in the amount of $400. The payable arises, or increases, when an expense is recorded simply the rest due is not paid at that time. An increment in salaries payable therefore reflects the fact that salaries expenses on the income statement are greater than the cash outgo relating to that expense. This ways that net cash menses from operating is greater than the reported internet income, regarding this cost.

Current Operating Liability Decrease

Decreases in electric current liabilities indicate a decrease in greenbacks relating to (1) accrued expenses, or (2) deferred revenues. In the first case, cash would have been expended to accomplish a decrease in liabilities arising from accrued expenses, all the same these greenbacks payments would not be reflected in the net income on the income statement. In the second instance, a decrease in deferred revenue means that some revenue would have been reported on the income statement that was collected in a previous menses. As a result, greenbacks flows from operating activities must be decreased by any reduction in current liabilities, to business relationship for (1) cash payments to creditors that are higher than the expense amounts on the income argument, or (2) amounts collected that are lower than the amounts reflected as income on the income statement. To reconcile cyberspace income to cash period from operating activities, subtract decreases in current liabilities.

Propensity Company had a decrease of $one,800 in the current operating liability for accounts payable. The fact that the payable decreased indicates that Propensity paid enough payments during the period to keep upwards with new charges, and also to pay down on amounts payable from previous periods. Therefore, the company had to have paid more in cash payments than the amounts shown as expense on the Income Statements, which means cyberspace cash flow from operating activities is lower than the related cyberspace income.

Analysis of Alter in Cash

Although the cyberspace income reported on the income argument is an of import tool for evaluating the success of the company'due south efforts for the electric current menstruation and their viability for future periods, the applied effectiveness of direction is not adequately revealed by the net income solitary. The net cash flows from operating activities adds this essential facet of information to the analysis, by illuminating whether the company'south operating greenbacks sources were adequate to cover their operating greenbacks uses. When combined with the cash flows produced by investing and financing activities, the operating activity cash flow indicates the feasibility of continuance and advancement of company plans.

Determining Cyberspace Cash Flow from Operating Activities (Indirect Method)

Net greenbacks menses from operating activities is the net income of the company, adjusted to reflect the cash affect of operating activities. Positive internet cash menses generally indicates adequate cash flow margins exist to provide continuity or ensure survival of the company. The magnitude of the internet cash flow, if large, suggests a comfy greenbacks flow cushion, while a smaller cyberspace greenbacks flow would signify an uneasy condolement cash flow zone. When a company's net cash catamenia from operations reflects a substantial negative value, this indicates that the company's operations are not supporting themselves and could be a warning sign of possible impending doom for the company. Alternatively, a small negative cash period from operating might serve equally an early alert that allows direction to make needed corrections, to ensure that cash sources are increased to amounts in excess of cash uses, for future periods.

For Propensity Company, beginning with internet income of $iv,340, and reflecting adjustments of $9,500, delivers a net cash catamenia from operating activities of $13,840.

Cash from Operating. (attribution: Copyright Rice Academy, OpenStax, under CC BY-NC-SA 4.0 license)

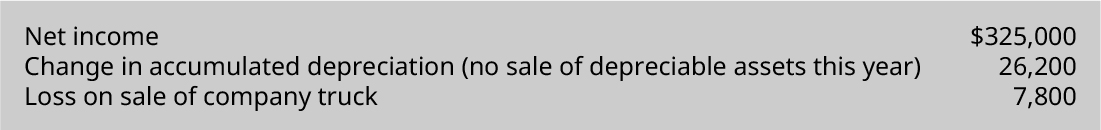

Cash Flow from Operating Activities

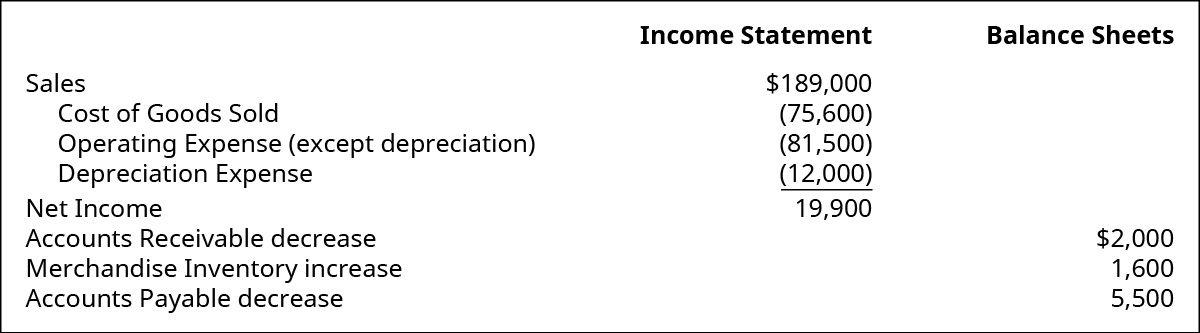

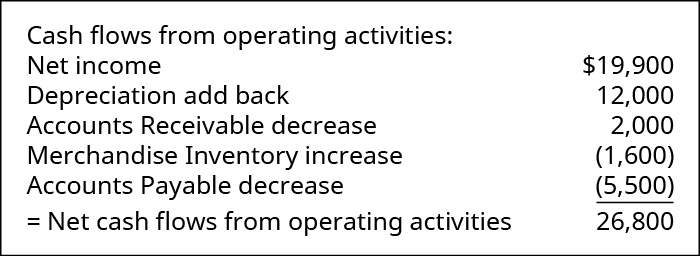

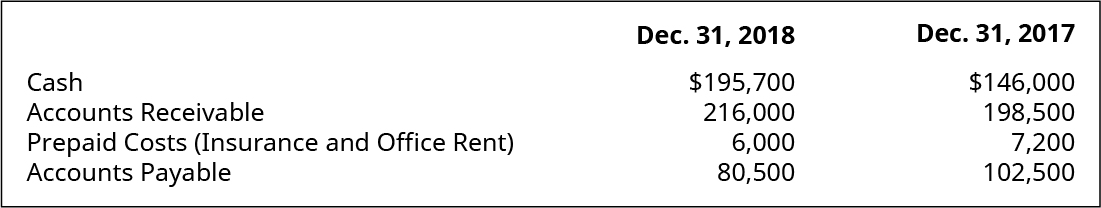

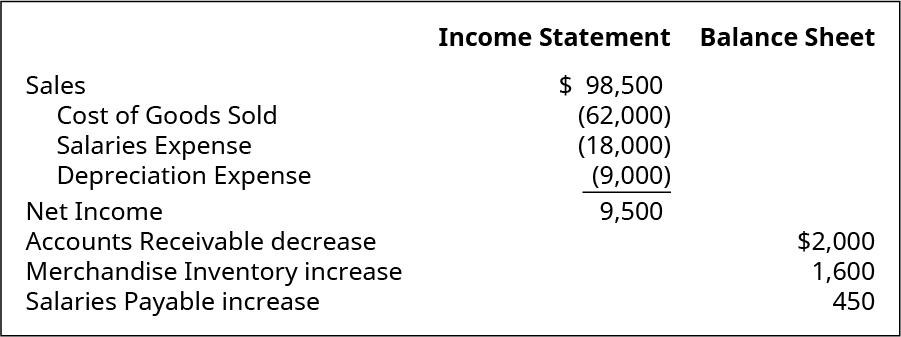

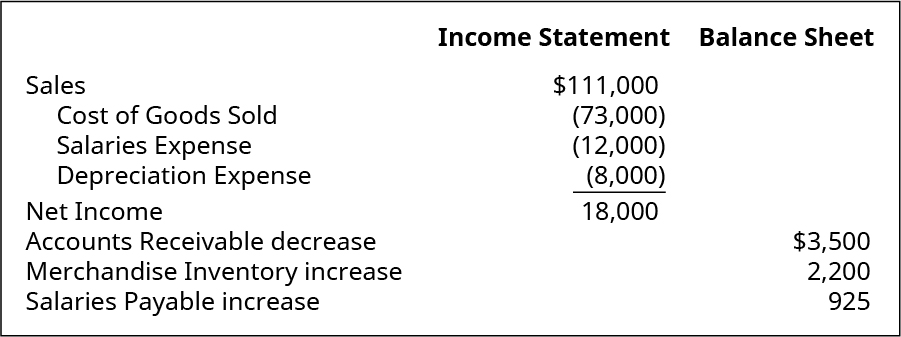

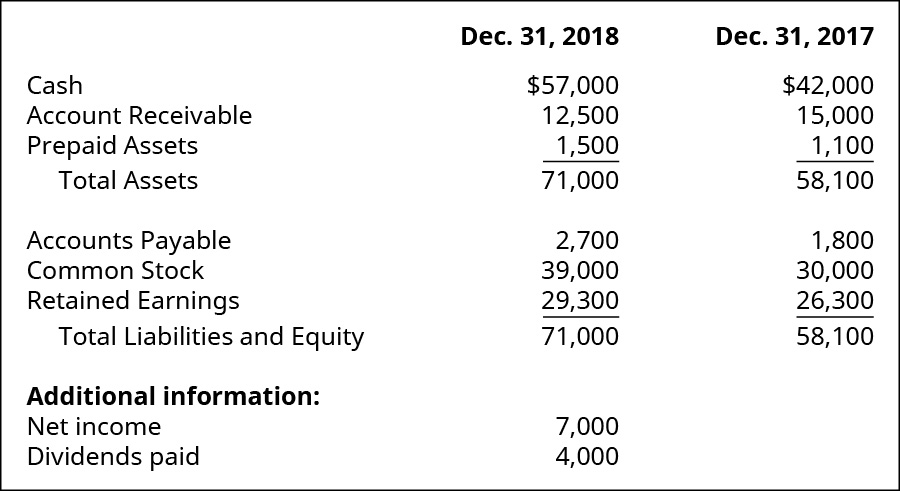

Presume you own a specialty bakery that makes gourmet cupcakes. Excerpts from your company's financial statements are shown.

How much cash menses from operating activities did your visitor generate?

Solution

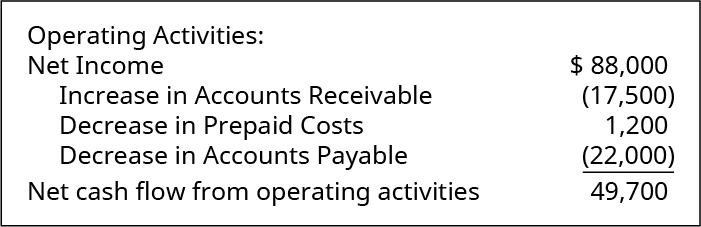

Explaining Changes in Greenbacks Balance

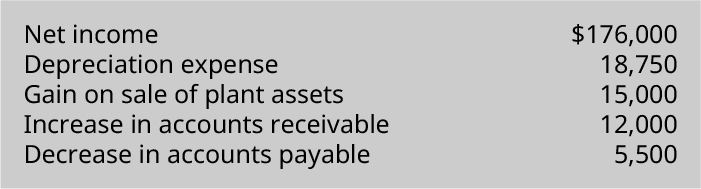

Assume that you are the main financial officer of a company that provides accounting services to pocket-size businesses. Yous are called upon by the lath of directors to explicate why your greenbacks balance did not increase much from the kickoff of 2018 until the end of 2018, since the company produced a reasonably strong profit for the year, with a cyberspace income of $88,000. Further assume that in that location were no investing or financing transactions, and no depreciation expense for 2018. What is your response? Provide the calculations to back up your reply.

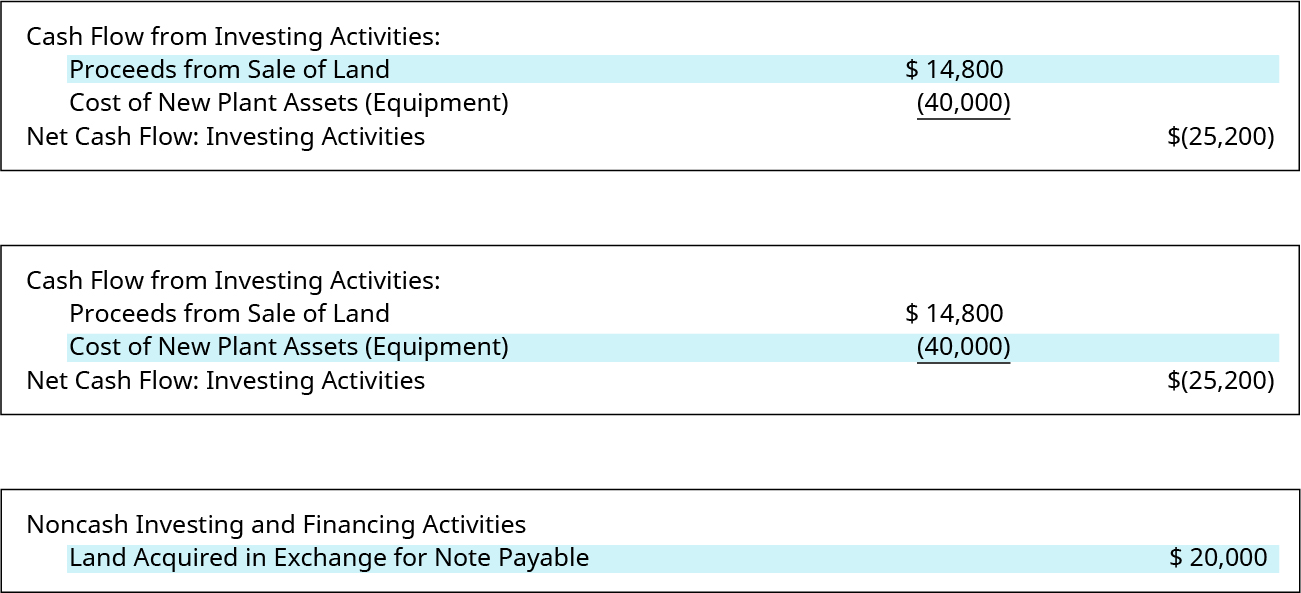

Set the Investing and Financing Activities Sections of the Statement of Cash Flows

Preparation of the investing and financing sections of the statement of cash flows is an identical process for both the direct and indirect methods, since only the technique used to arrive at net cash flow from operating activities is affected by the choice of the direct or indirect approach. The post-obit sections discuss specifics regarding preparation of these two nonoperating sections, besides as notations well-nigh disclosure of long-term noncash investing and/or financing activities. Changes in the diverse long-term avails, long-term liabilities, and equity can exist adamant from analysis of the company'due south comparative residue canvass, which lists the current menstruum and previous period balances for all assets and liabilities.

Investing Activities

Cash flows from investing activities e'er relate to long-term asset transactions and may involve increases or decreases in cash relating to these transactions. The most common of these activities involve purchase or sale of property, found, and equipment, only other activities, such as those involving investment assets and notes receivable, too represent cash flows from investing. Changes in long-term assets for the period tin can be identified in the Noncurrent Avails section of the company'south comparative balance sheet, combined with any related gain or loss that is included on the income statement.

In the Propensity Company example, the investing section included two transactions involving long-term assets, ane of which increased cash, while the other one decreased greenbacks, for a total net cash menstruation from investing of ($25,200). Analysis of Propensity Company's comparative residuum sail revealed changes in land and plant avails. Further investigation identified that the modify in long-term assets arose from three transactions:

- Investing activity: A tract of land that had an original cost of $10,000 was sold for $fourteen,800.

- Investing activity: Plant assets were purchased, for $40,000 cash.

- Noncash investing and financing activity: A new parcel of land was acquired, in exchange for a $twenty,000 annotation payable.

Details relating to the handling of each of these transactions are provided in the following sections.

Investing Activities Leading to an Increase in Cash

Increases in net cash flow from investing ordinarily arise from the sale of long-term assets. The cash impact is the cash proceeds received from the transaction, which is non the same amount every bit the gain or loss that is reported on the income statement. Gain or loss is computed by subtracting the asset's net volume value from the cash gain. Internet book value is the nugget's original price, less whatever related accumulated depreciation. Propensity Company sold land, which was carried on the remainder canvass at a net volume value of $10,000, representing the original purchase cost of the land, in exchange for a greenbacks payment of $14,800. The data set explained these net book value and cash proceeds facts for Propensity Company. However, had these facts non been stipulated in the information set, the cash proceeds could have been determined by adding the reported $4,800 gain on the sale to the $10,000 cyberspace volume value of the asset given up, to arrive at cash proceeds from the sale.

Investing Activities Leading to a Decrease in Cash

Decreases in net greenbacks menstruum from investing normally occur when long-term avails are purchased using greenbacks. For example, in the Propensity Visitor example, there was a decrease in cash for the period relating to a simple purchase of new plant assets, in the amount of $40,000.

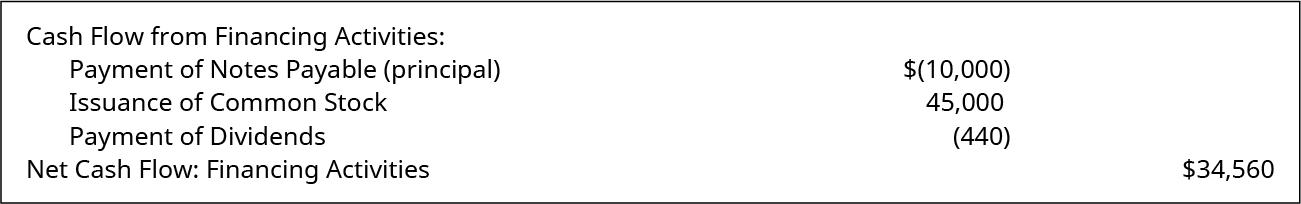

Financing Activities

Cash flows from financing activities ever chronicle to either long-term debt or disinterestedness transactions and may involve increases or decreases in cash relating to these transactions. Stockholders' equity transactions, like stock issuance, dividend payments, and treasury stock buybacks are very common financing activities. Debt transactions, such as issuance of bonds payable or notes payable, and the related principal payback of them, are too frequent financing events. Changes in long-term liabilities and equity for the period tin can be identified in the Noncurrent Liabilities section and the Stockholders' Equity department of the company's Comparative Balance Sheet, and in the retained earnings statement.

In the Propensity Company case, the financing section included three transactions. 1 long-term debt transaction decreased cash. Two transactions related to equity, one of which increased cash, while the other i decreased cash, for a total net cash flow from financing of $34,560. Analysis of Propensity Company's Comparative Balance Sheet revealed changes in notes payable and common stock, while the retained earnings statement indicated that dividends were distributed to stockholders. Further investigation identified that the change in long-term liabilities and disinterestedness arose from three transactions:

- Financing activity: Primary payments of $ten,000 were paid on notes payable.

- Financing activity: New shares of common stock were issued, in the amount of $45,000.

- Financing activity: Dividends of $440 were paid to shareholders.

Specifics nearly each of these three transactions are provided in the following sections.

Financing Activities Leading to an Increase in Greenbacks

Increases in net cash flow from financing usually arise when the company bug share of stock, bonds, or notes payable to heighten capital for cash flow. Propensity Visitor had one example of an increase in greenbacks flows, from the issuance of mutual stock.

Financing Activities Leading to a Decrease in Cash

Decreases in cyberspace cash flow from financing normally occur when (1) long-term liabilities, such every bit notes payable or bonds payable are repaid, (ii) when the company reacquires some of its ain stock (treasury stock), or (three) when the company pays dividends to shareholders. In the instance of Propensity Company, the decreases in cash resulted from notes payable primary repayments and cash dividend payments.

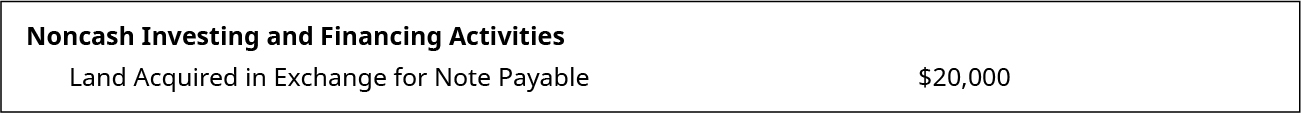

Noncash Investing and Financing Activities

Sometimes transactions can be very important to the company, yet not involve whatsoever initial change to cash. Disclosure of these noncash investing and financing transactions can be included in the notes to the financial statements, or every bit a notation at the bottom of the statement of cash flows, after the entire statement has been completed. These noncash activities usually involve one of the following scenarios:

- exchanges of long-term assets for long-term liabilities or equity, or

- exchanges of long-term liabilities for equity.

Propensity Company had a noncash investing and financing activity, involving the purchase of country (investing action) in exchange for a $xx,000 note payable (financing activity).

Summary of Investing and Financing Transactions on the Cash Flow Argument

Investing and financing transactions are critical activities of business concern, and they often represent significant amounts of company equity, either as sources or uses of cash. Common activities that must be reported as investing activities are purchases of country, equipment, stocks, and bonds, while financing activities normally relate to the company's funding sources, namely, creditors and investors. These financing activities could include transactions such as borrowing or repaying notes payable, issuing or retiring bonds payable, or issuing stock or reacquiring treasury stock, to proper name a few instances.

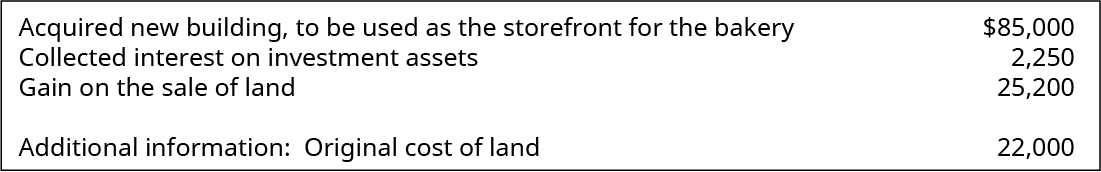

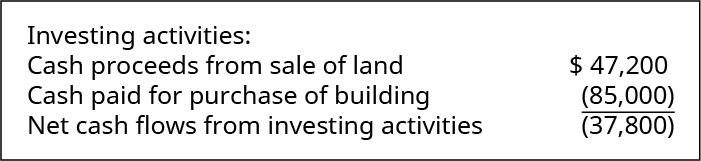

Cash Flow from Investing Activities

Assume your specialty baker makes gourmet cupcakes and has been operating out of rented facilities in the past. You owned a piece of land that you lot had planned to someday employ to build a sales storefront. This year your visitor decided to sell the land and instead buy a edifice, resulting in the following transactions.

What are the greenbacks flows from investing activities relating to these transactions?

Solution

Annotation: Involvement earned on investments is an operating activeness.

Cardinal Concepts and Summary

- Preparing the operating section of statement of cash flows past the indirect method starts with net income from the income statement and adjusts for items that affect cash flows differently than they affect cyberspace income.

- Multiple levels of adjustments are required to reconcile accrual-based internet income to cash flows from operating activities.

- The investing department of statement of cash flows relates to changes in long-term assets.

- The financing section of statement of greenbacks flows relates to changes in long-term liabilities and changes in equity.

- Company activities that reflect changes in long-term assets, long-term liabilities, or equity, but have no cash touch on, require special reporting treatment, as noncash investing and financing transactions.

Multiple Selection

(Effigy)What is the effect on greenbacks when current noncash operating assets increase?

- Greenbacks increases past the same amount.

- Cash decreases past the same amount.

- Greenbacks decreases by twice as much.

- Cash does not change.

(Figure)What is the issue on cash when electric current liabilities increment?

- Cash increases by the aforementioned corporeality.

- Cash decreases by the aforementioned amount.

- Cash decreases by twice every bit much.

- Cash does not change.

(Figure)What is the issue on cash when current noncash operating assets subtract?

- Cash increases by the same amount.

- Greenbacks decreases by the same corporeality.

- Cash decreases by twice as much.

- Cash does not change.

(Figure)What is the effect on cash when electric current liabilities decrease?

- Greenbacks increases by the same amount.

- Cash decreases by the same amount.

- Cash decreases by twice as much.

- Cash does non change.

(Figure)Which of the post-obit would trigger a subtraction in the indirect operating section?

- gain on sale of investments

- depreciation expense

- decrease in accounts receivable

- decrease in bonds payable

(Figure)Which of the post-obit represents a source of greenbacks in the investing section?

- sale of investments

- depreciation expense

- subtract in accounts receivable

- decrease in bonds payable

(Effigy)Which of the post-obit would be included in the financing section?

- loss on sale of investments

- depreciation expense

- increase in notes receivable

- subtract in notes payable

Questions

(Effigy)Explain the difference between the 2 methods used to set up the operating section of the statement of cash flows. How do the results of these two approaches compare?

The indirect method begins with internet income and adjusts for items that bear upon greenbacks differently than they bear on internet income, whereas the direct method requires that each revenue and expense item exist converted to reverberate the cash impact from that item. The cyberspace cash flow result is the same, no matter which of the two methods is used.

(Figure)Why is depreciation an addition in the operating department of the argument of cash flows, when prepared past the indirect method?

(Effigy)When preparing the operating section of the argument of cash flows, using the indirect method, how must gains and losses exist handled? Why?

Gains and losses must exist removed from the operating section. To achieve this, reverse the consequence of gains or losses; if a gain has been added to internet income, it should be subtracted in the operating section; if a loss has been deducted to go far at cyberspace income, it should be added dorsum in the operating department. Why? Offset, gains and losses relate to long-term assets, which autumn nether investing activities, not operating activities. Second, the gain/(loss) on the sale of long-term assets represents the excess/(deficiency) computed when the asset'southward cost basis is subtracted from sales proceeds, then the number does not accurately represent the cash flow relating to the transaction.

(Figure)If a company reports a gain/(loss) from the sale of assets, every bit function of the internet income on the income statement, and the net volume value of those assets on the date of the sale is known, can the amount of the greenbacks proceeds from the sale be determined? If so, how?

(Figure)Notation payments reduce cash and are related to long-term debt. Do these facts automatically atomic number 82 to their inclusion as elements of the financing department of the argument of cash flows? Explain.

Not necessarily. Only the main balance repayment should be included in the financing section; the interest component of the note payment is an operating activity.

Exercise Set A

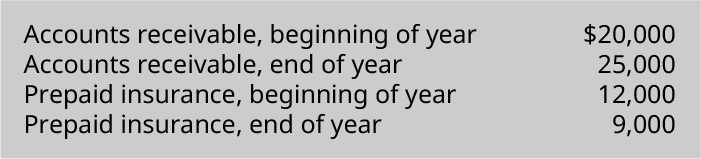

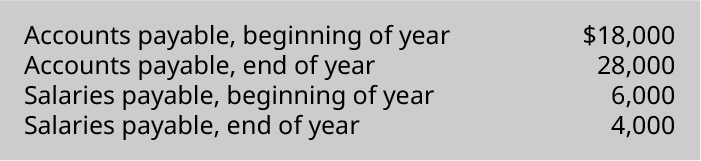

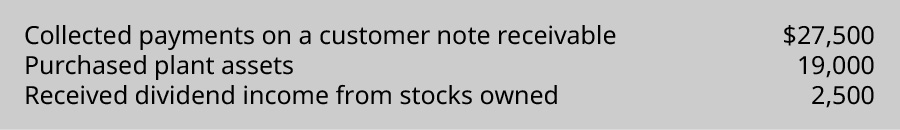

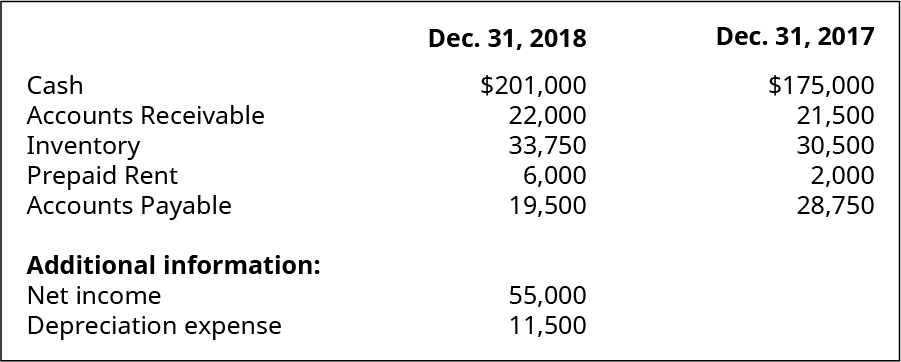

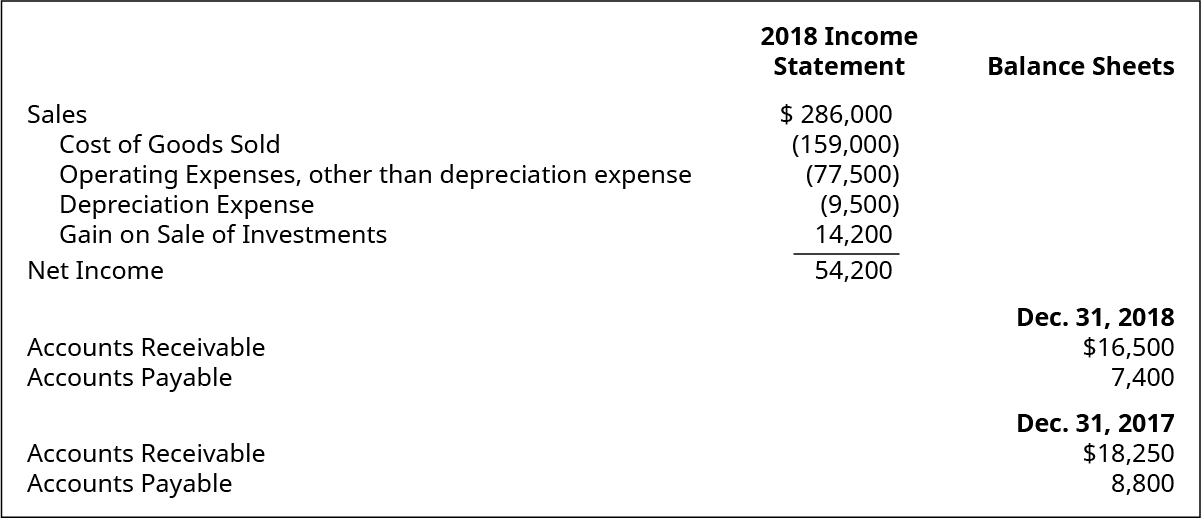

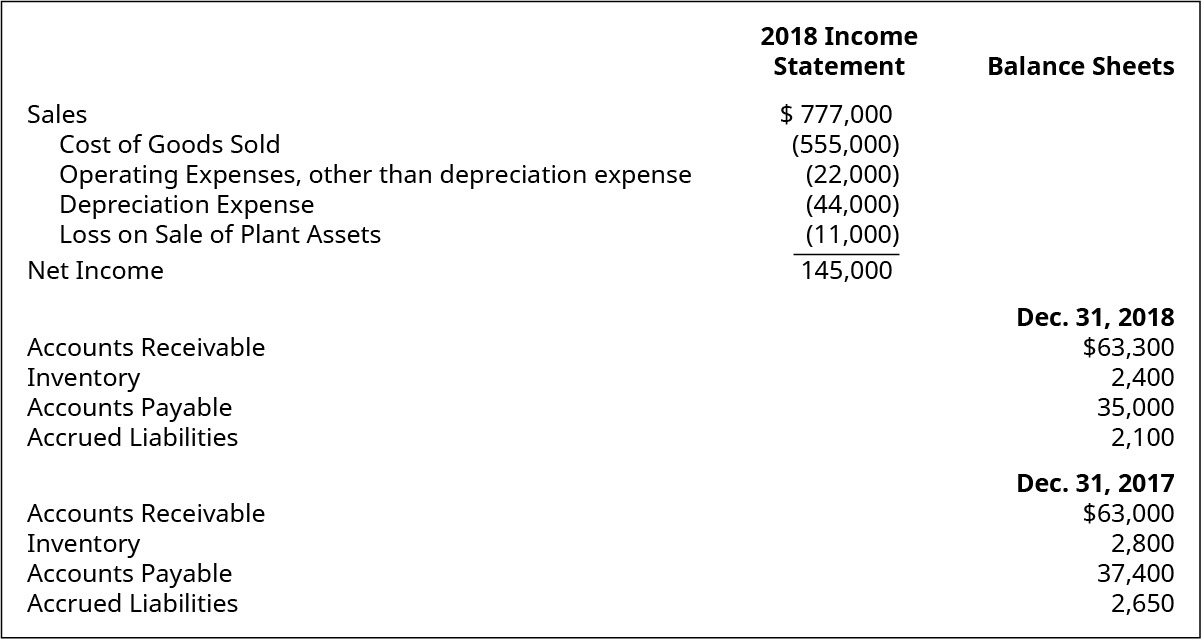

(Figure)Employ the following information from Albuquerque Company's fiscal statements to determine operating net greenbacks flows (indirect method).

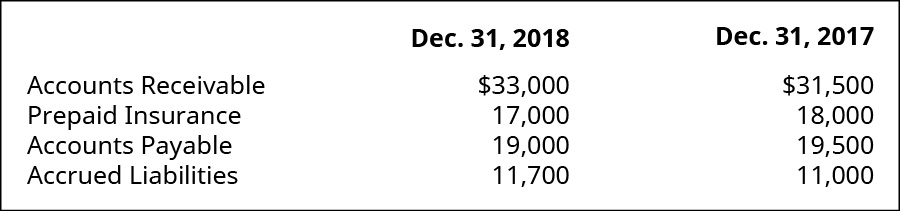

(Figure)What adjustment(s) should be made to reconcile net income to cyberspace greenbacks flows from operating activities (indirect method) because the following balances in current assets?

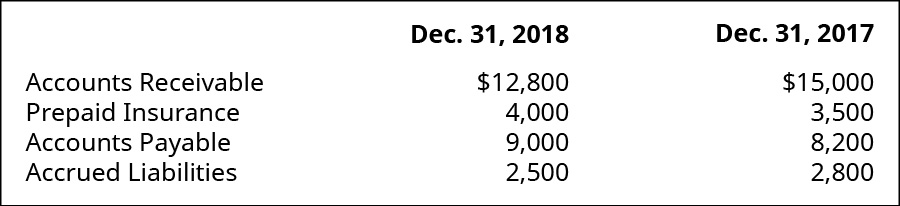

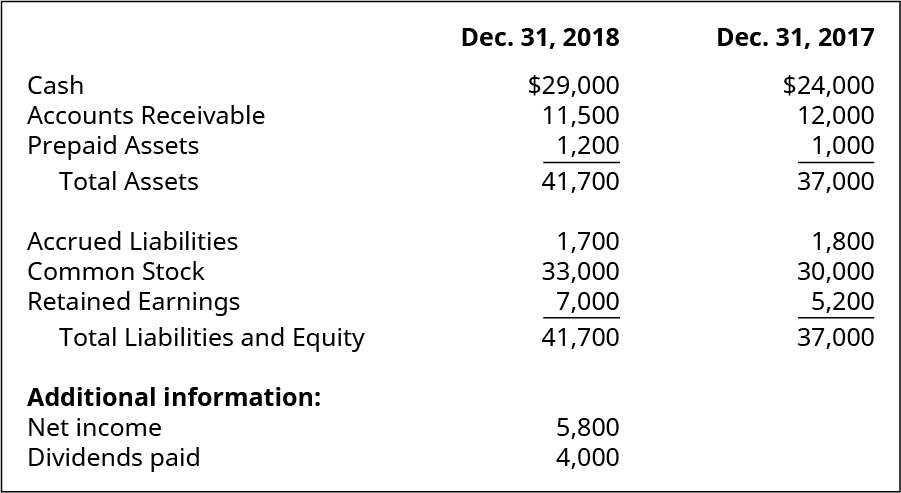

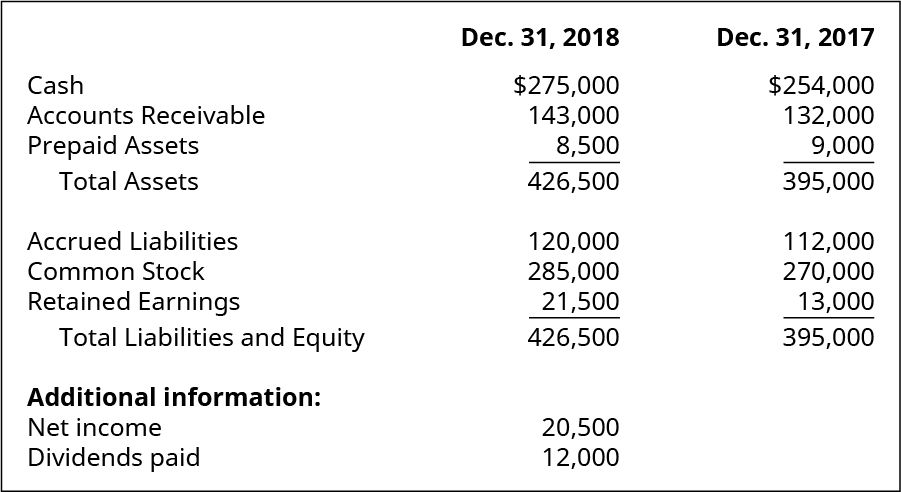

(Figure)Apply the post-obit information from Birch Visitor's balance sheets to make up one's mind net cash flows from operating activities (indirect method), bold net income for 2018 of $122,000.

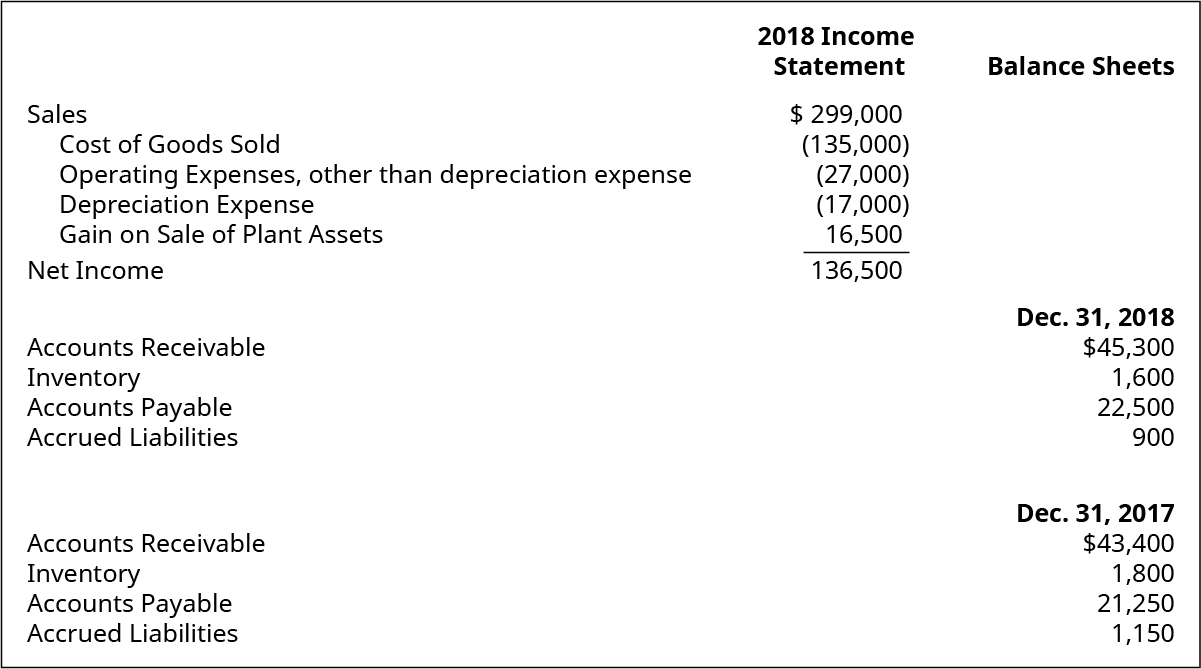

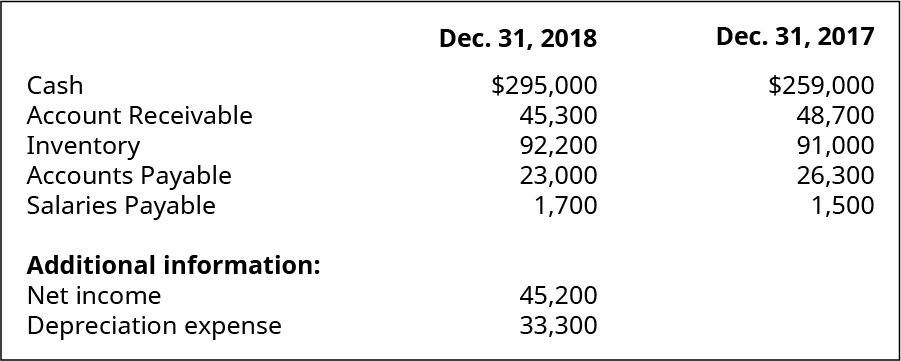

(Figure)Use the following information from Chocolate Company's financial statements to decide operating net cash flows (indirect method).

(Figure)Use the post-obit information from Denmark Company's fiscal statements to determine operating net cash flows (indirect method).

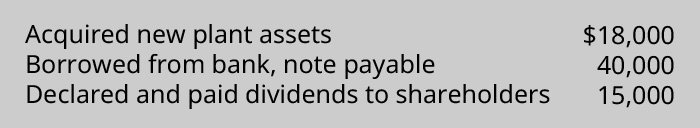

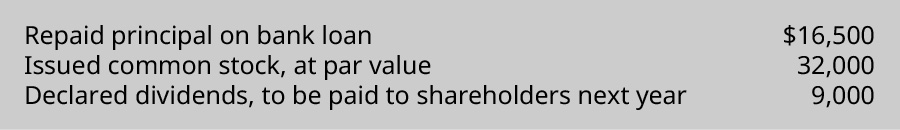

(Figure)Utilize the following excerpts from Eagle Visitor's financial records to determine net greenbacks flows from financing activities.

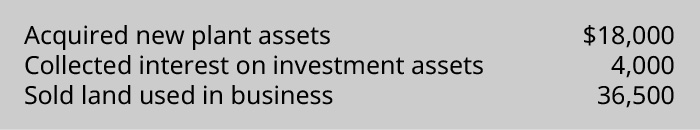

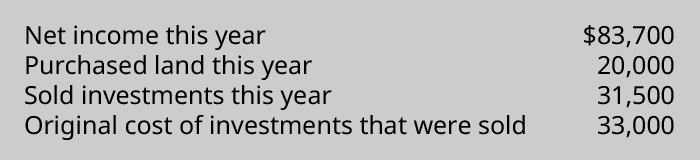

(Figure)Employ the following excerpts from Fruitcake Company's financial records to determine net cash flows from investing activities.

(Figure)Use the post-obit excerpts from Grenada Visitor'southward financial records to determine net cash flows from operating activities and net cash flows from investing activities.

Exercise Ready B

(Figure)Use the following information from Hamlin Company'south financial statements to decide operating net cash flows (indirect method).

(Figure)What adjustment(s) should be fabricated to reconcile net income to cyberspace cash flows from operating activities (indirect method) considering the following balances in current assets?

(Figure)Use the following excerpts from Indigo Visitor's residuum sheets to determine net greenbacks flows from operating activities (indirect method), bold net income for 2018 of $225,000.

(Effigy)Utilize the post-obit information from Jumper Company'due south financial statements to determine operating internet cash flows (indirect method).

(Figure)Utilize the post-obit information from Kentucky Company'southward financial statements to determine operating net cash flows (indirect method).

(Figure)Use the following excerpts from Leopard Company's financial records to determine net cash flows from investing activities.

(Figure)Employ the following data from Manuscript Visitor's fiscal records to determine net cash flows from financing activities.

(Figure)Use the following excerpts from Nutmeg Visitor'due south fiscal records to decide net greenbacks flows from operating activities and net cash flows from investing activities.

Trouble Set A

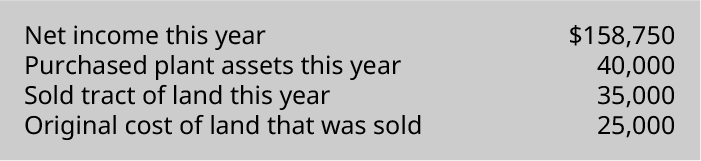

(Effigy)Employ the following information from Acorn Company's financial statements to decide operating cyberspace cash flows (indirect method).

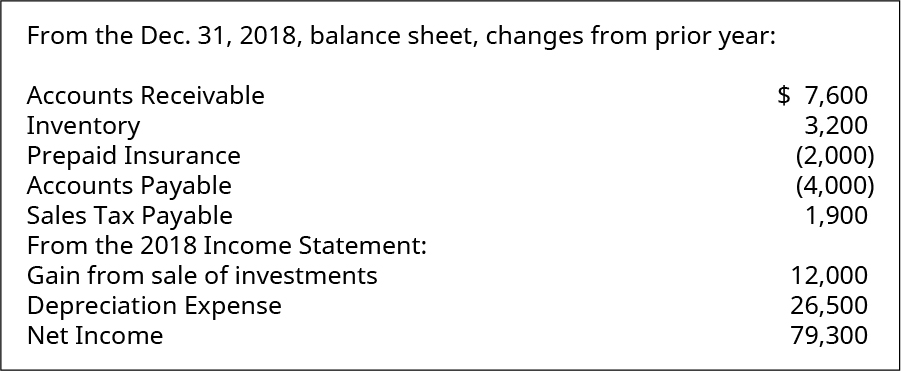

(Figure)Use the post-obit information from Berlin Visitor's financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018.

(Figure)Use the following information from Coconut Company's financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018.

(Figure)Use the post-obit information from Dubuque Company's fiscal statements to set the operating activities section of the statement of cash flows (indirect method) for the year 2018.

(Figure)Utilise the following information from Eiffel Company's financial statements to prepare the operating activities section of the argument of cash flows (indirect method) for the year 2018.

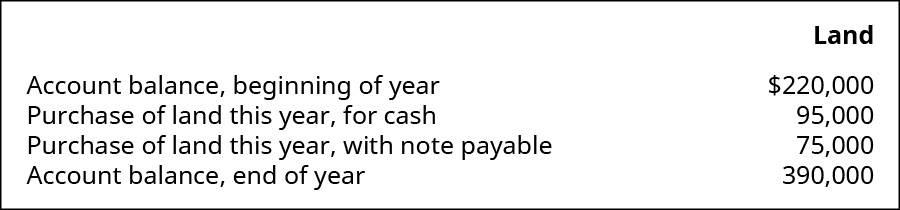

(Effigy)Analysis of Forest Company's accounts revealed the following activity for its State account, with descriptions added for clarity of analysis. How would these two transactions be reported for greenbacks flow purposes? Note the section of the argument of cash flow, if applicable, and if the transaction represents a cash source, greenbacks use, or noncash transaction.

Problem Set B

(Figure)Use the following information from Grenada Company's financial statements to prepare the operating activities department of the statement of cash flows (indirect method) for the yr 2018.

(Figure)Employ the following information from Honolulu Company's financial statements to prepare the operating activities section of the argument of cash flows (indirect method) for the year 2018.

(Figure)Employ the following information from Isthmus Company's fiscal statements to ready the operating activities department of the statement of cash flows (indirect method) for the twelvemonth 2018.

(Effigy)Use the following information from Juniper Company's financial statements to prepare the operating activities department of the statement of cash flows (indirect method) for the year 2018.

(Figure)Use the following excerpts from Kayak Company's fiscal data to ready the operating section of the statement of greenbacks flows (indirect method) for the year 2018.

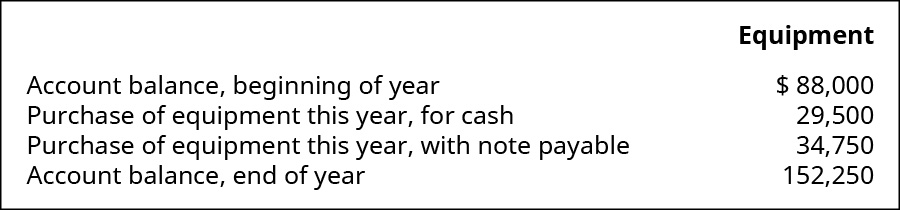

(Figure)Analysis of Longmind Company's accounts revealed the following activity for Equipment, with descriptions added for clarity of analysis. How would these two transactions be reported for cash flow purposes? Note the section of the statement of cash menstruum, if applicable, and if the transaction represents a cash source, cash use, or noncash transaction.

| Equipment | |

| Account residue, beginning of year | $ 88,000 |

| • Purchase of equipment this yr, for cash | 29,500 |

| • Purchase of equipment this year, with note payable | 34,750 |

| Business relationship balance, end of twelvemonth | 152,250 |

Thought Provokers

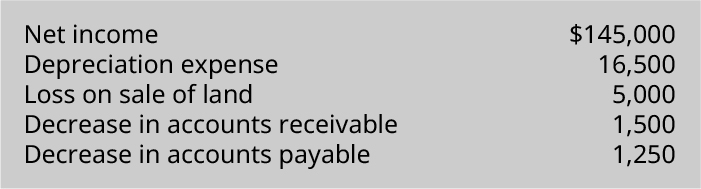

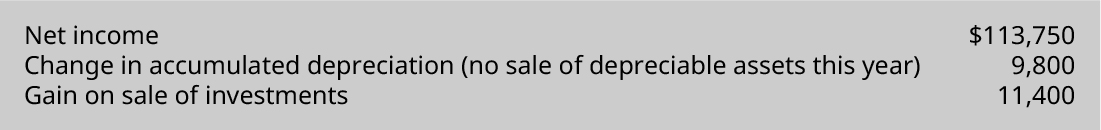

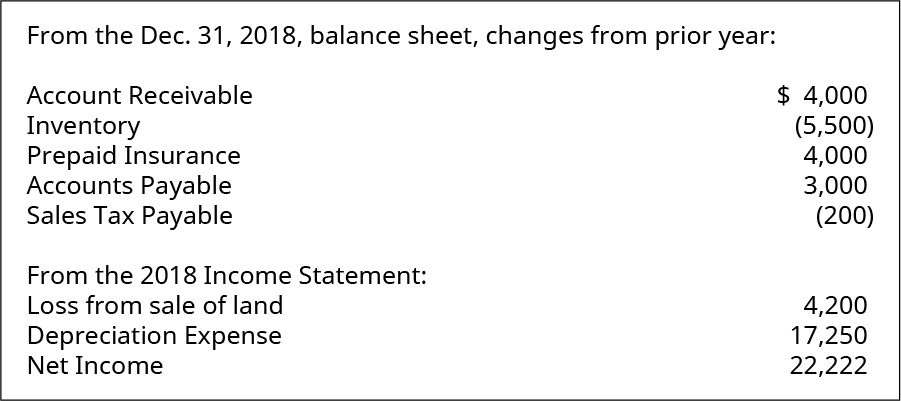

(Figure)Employ a spreadsheet and the following fiscal information from Mineola Company's financial statements to build a template that automatically calculates the net operating cash menses. It should be suitable for use in preparing the operating section of the statement of cash flows (indirect method) for the yr 2018.

(Figure)Consider the dilemma you might anytime face if you are the chief financial officer of a visitor that is struggling to maintain a positive cash flow, despite the fact that the visitor is reporting a substantial positive cyberspace income. Maybe the trouble is then astringent that there is often insufficient cash to pay ordinary business expenses, like utilities, salaries, and payments to suppliers. Presume that you take been asked to communicate to your board of directors about your company's year, in retrospect, likewise equally your vision for the visitor's future. Write a memo that expresses your insights about past experience and nowadays prospects for the company. Notation that the claiming of the consignment is to keep your integrity intact, while putting a positive spin on the situation, equally much as is reasonably possible. How can you envision the situation turning into a success story?

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/prepare-the-statement-of-cash-flows-using-the-indirect-method/

Posted by: kerrseallegaid.blogspot.com

0 Response to "Which Of The Following Cash Transactions Results In No Net Change In Assets?"

Post a Comment